Overview

A Housing Needs Assessment can help a municipality understand where gaps in affordability and availability exist within their current housing stock.

Housing Needs Assessments are completed by analyzing aggregated data from the American Community Survey released by the U.S. Department of Housing and Urban Development. The assessments use the State and Federal definition of affordable housing, which states that households should pay no more than 30% of their household income on housing costs.

A Housing Needs Assessment examines affordability by estimating cost burdened renter and owner households.

Households are considered cost burdened when they are spending more than 30% of their household income on housing costs. Households are considered severely cost burdened when they spend more than 50% of their household income on housing costs.

The assessment estimates the number of renter and owner households by income group who are cost burdened and severely cost burdened.

A Housing Needs Assessment examines availability of affordable units by comparing the cost of a community’s housing stock to the income of renter and owner households who live within that community.

This is done by using the data’s reliable estimates on housing costs for rental and homeownership units as well as household income for renters and owners.

The assessments group renter households and owner households into categories based on their income and then estimate how many housing units are currently available and occupied by each income group in the municipality. When a housing unit is “affordable” to a household based on its income group, those households will not pay more than 30% of their income on housing costs.

A housing gap occurs when there are not enough units affordable to households in a defined income category. This primarily happens in two ways:

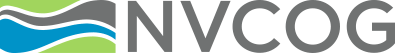

- There are enough homes available to a certain income group, but those housing units are occupied by households in other income groups.

a. For example, if there are 1,000 units considered affordable to those making 0-30% of the Area Median Income and 700 households in that income group, there should be a surplus of 300 units affordable. However, if 500 of those units are occupied by households who are earning more than 0-30% of the Area Median Income, only 500 units affordable to households earning 0-30% of the Area Median Income are “available” for those households. There exists a housing gap of 200 units affordable and available to that income group.

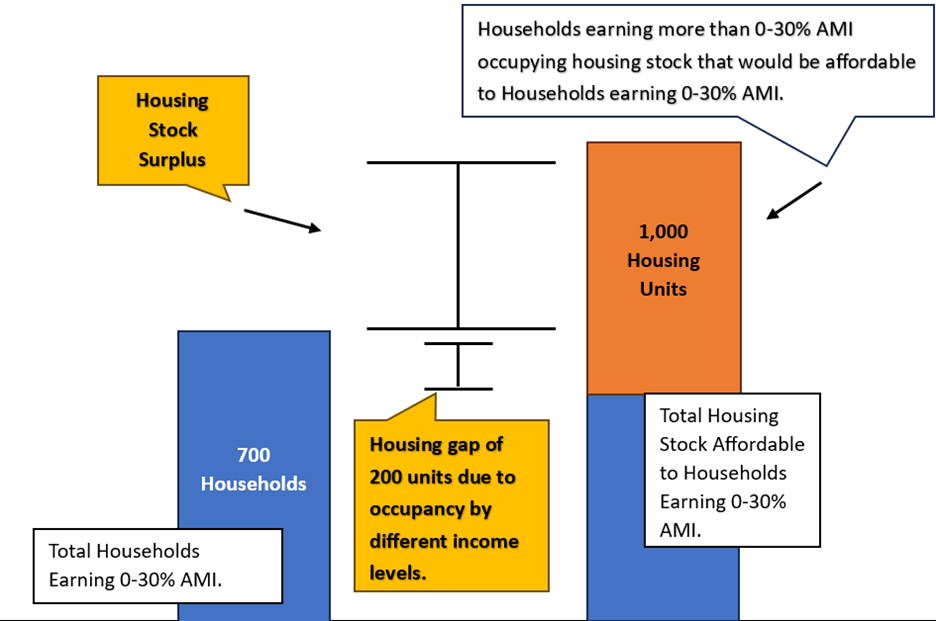

2. There are more renters or owners in an income group than there are housing units available to that group.

a. For example, if there are 500 households who earn 0-30% of the Area Median Income, and 450 housing units considered affordable to households earning 0-30% of the Area Median Income, then there is a gap of 50 housing units available to that income group.

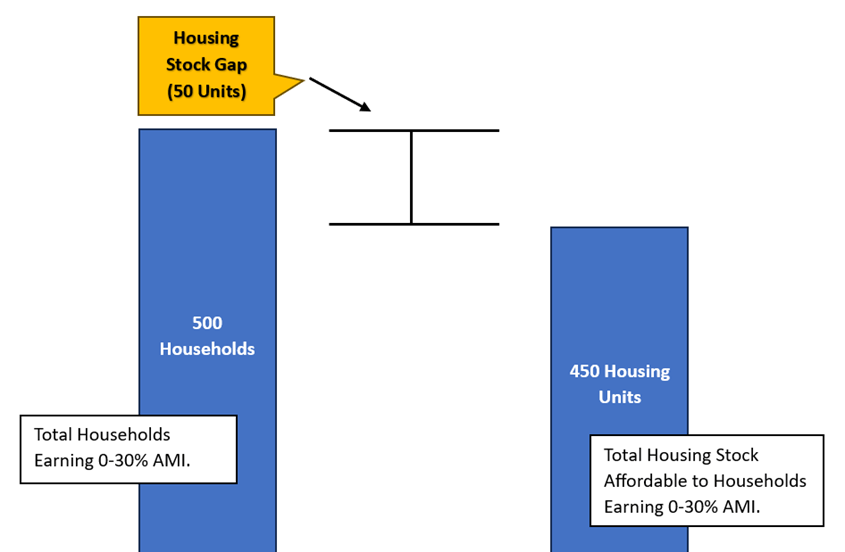

Assessments can also estimate a housing surplus. A surplus in housing units exists when there are more units affordable and available to an income group than there are members of that group.

a. For example, if a community has 500 households that earn 0-30% of the Area Median Income and 600 housing units considered affordable to this group, then there exists a surplus of 100 housing units for those households. Understanding where these gaps exist in a municipalities’ housing stock can contribute to better planning for that community’s housing needs.

Insights & Progress on Housing Needs Assessments

NVCOG creates Housing Needs Assessments on an as-needed basis for member municipalities. Currently, there are three completed Housing Needs Assessments for the Naugatuck Valley region. In the coming months, NVCOG aims to assist in completing assessments for more communities in the region.

If your municipality is interested in having a Housing Needs Assessment completed, or would like to learn more about the assessments, please contact Savannah-Nicole Villalba at snvillalba@nvcogct.gov.

Completed Housing Needs Assessments

Staff Contact:

Savannah-Nicole Villalba, AICP, AZT

Community Planning Director

snvillalba@nvcogct.gov